Any economic activity of the organization is impossible without the movement of financial flows. Cash is involved in all processes taking place at enterprises of any form of ownership. The purchase of working capital, investment in fixed assets, settlements with budgets of various levels, founders, employees of the enterprise - all production and administrative actions are carried out with the help of money and in order to obtain them.

Types of Settlement

In practice, two main types of payments are used - cash and cashless. Cash, as a rule, is used for small amounts of cash flow - these are lump-sum payments that can be made through the cash desk of the company. For small enterprises with low turnover and modest income, the use of cash is the best option. Large companies often adopt a cashless system; as shown by the results of its use, it is much more efficient, faster and cheaper than working with large amounts of cash. Therefore, today 98% of all payments are carried out through the banking system, by non-cash principle.

The reflection of the cashless system in accounting

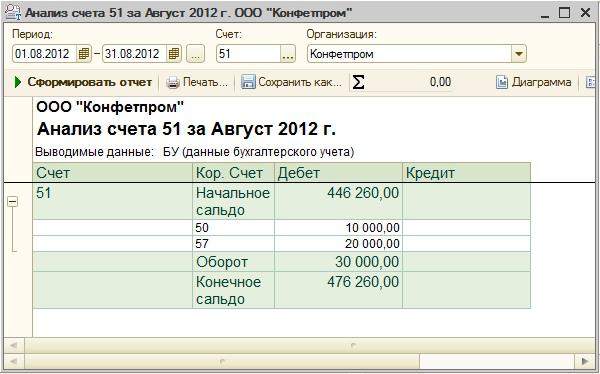

For analysis, planning, accounting, moving non-cash, the company opens a synthetic, balance-sheet account 51. It is active, which means reflecting incoming funds by debit, the expenditure of financial resources - by credit. 51 accounts were created to account for the most mobile of the enterprise’s assets - non-cash funds. It is reflected in the balance sheet in a generalized form, the balance (balance) is determined daily for the operational management of finances. Analytical accounting is conducted for each item of income and expense separately. An organization may simultaneously open the required number of accounts in one or more credit institutions. Regardless of their number, all information on the movement of cashless funds is summarized and posted to 51 accounts. The balance (balance) is formed by the formula: balance at the beginning + turnover on the debit of the account - turnover on the loan. The result obtained is the sum of available (currently) funds. It is credited to 51 accounts as the initial debit balance for the next period.

Types of cashless payments

All settlement and payment transactions are carried out by the bank with which the organization has concluded an account maintenance agreement. The basis for making withdrawals or transfers of funds is a written notice to the owner, which is checked by bank employees for compliance with legal standards and unified forms. The organization that owns the funds chooses the non-cash payment form on its own, based on the contractual obligations of specific contractors. Most often, the payer company, using the appropriate document, gives the bank an order to withdraw (write off, transfer) non-cash funds from the account in favor of the specified counterparty. Unconditional write-offs are less common, confirmation of which is not required from the owner of the assets. Cash withdrawals for own needs are made by the organization using checks. Account holders at the bank receive the required limit of checks based on the application. Checkbook pages filled out and certified by appropriate signatures and seals can also serve as settlements for the account holder company with contracting organizations, suppliers, etc. In this case, the check is written to the organization or individual (its representative) and cashed upon presentation at the bank payer.

Document flow on the current account

51 accounts are maintained on the basis of a bank statement. Documents must be attached to it, which serve as an order for the movement of funds on a specific account of the enterprise. All write-offs, transfers that the owner of the assets made over the period of the statement are confirmed by a copy of the outgoing payment order or requirement. The spine of the check justifies the withdrawal of cash. The crediting of the received amounts from the owner company (handing over part of the proceeds in cash) is fixed by a bank order. Funds received from buyers and other debtors, as part of their contractual obligations, are confirmed by a copy of the incoming payment order of the paying organization. All documents on the transfer of non-cash money are drawn up in strict accordance with the unified forms and requirements of the bank, certified by the signatures of authorized persons and the seal of the organization.

Debit

The debit 51 of the account is a reflection of cash receipts. Enrollment comes from the following sources:

- Cash desk of the enterprise (D 51, K 50) - this transaction is compiled when cash is credited to the current account from the cash desk.

- Settlements with counterparties (D 51, K 62/60/76) - the amount credited to the account from buyers, other debtors, and suppliers (advance payment, excessively transferred funds, settlements on claims made).

- Credits, loans, loans (D 51, K 66) - the operation is carried out in case of receipt of borrowed funds to the current account.

- When settling with shareholders and owners (D 51, K 75), the funds of the founders were contributed (as working capital or with an increase in the authorized capital).

- Settlements with budgets and extra-budgetary organizations (D 51, K 68, 69) - excessively paid taxes or the amount of social support of the population (benefits, sick leave, etc.) are listed.

The debit turnover is summed up over the reporting time period and is a generalized indicator of the receipt of funds in the current account of the enterprise. For the analysis of income by articles, the balance sheet or account analysis is used.

Loan movement

Credit account 51 is formed from the write-off (expense) of non-cash funds of the enterprise. The loan turnover shows the total amount of transfers, write-offs and cash withdrawals deposited to account 51. The loan transactions are as follows:

- Cash withdrawal (D 50, K 51) - the funds received at the cash desk of the enterprise were withdrawn from the current account (cashing out occurs in a limited manner, indicating the item of expenses). Most often, organizations use part of the funds when paying wages or for household needs.

- Transfer of non-cash (D 51/55, K 51) - this correspondence is carried out when transferring part of the funds to another account or to open special letters of credit intended for settlements with counterparties.

- Payment to suppliers, contractors and other creditors (D 60/62/76, K 51) - transfer of the amount of assets from the current account to the counterparties (for goods and services, product returns, etc.).

- Settlements for loans, borrowings and loans (D 66, K 51) - the interest for using borrowed funds is listed or the debt on loans is repaid .

- Fulfillment of obligations to budgets of various levels and extra-budgetary funds (D 68/69, K 51) - depending on tax or fund, corresponding sub-accounts are indicated in correspondence.

- Salary (D 70, K 51) - paid to employees.

- Settlements with founders (D 75, K 51) - based on the results of the activity, payments were made to the founders.