Inflation and devaluation are two different things. The first term refers to an increase in domestic prices, which does not always occur in all consumer segments in equal proportions. For example, the rent may rise in price, and the price of potatoes will remain the same or even decrease.

Devaluation means an increase in foreign exchange rates in relation to the official state currency. The reverse process is called revaluation.

Why, at a certain historical stage, some conventional unit was chosen as a standard, for what reasons did it indicate the price? Cu (more simply, the dollar), for many years in our country served as an indexer and devaluation, and inflation. What is the reason?

Universal measure

There was a time when the Soviet and then the Russian ruble lost their purchasing power almost simultaneously with the growth of the dollar, and very quickly. Today's citizens, at the age of forty and older, remember well what u is. e., youth, this concept is less known. After the actual collapse of the Soviet monetary system, the American dollar, for the special color scheme called “greens” or “cabbage”, became the yardstick for evaluating the objects of sale (and almost all).

It was unusual for citizens of a great country to use foreign money for settlements, and sometimes even to be ashamed. There is nothing to be done, it is impossible to remove from the history of pages. What was, was.

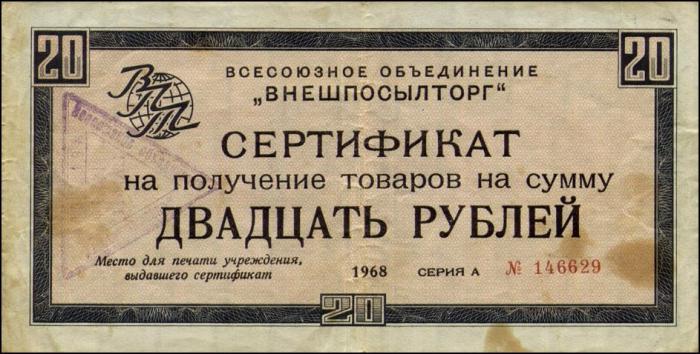

Torgsins and check stores

Foreign exchange shops existed in the USSR and in relatively prosperous pre-perestroika times. The Torgsins discovered at all in the distant twenties. The goal of creating these trading organizations was twofold. Firstly, to encourage Soviet citizens to part with the gold and currency values in an organized manner, in exchange for what was available to everyone abroad, and in the Soviet Union there was a shortage. Secondly, foreigners could make purchases out of turn here, comfortably, and thereby avoid contacts with Soviet trade (they did not need to know about it, otherwise they would tell about it there ...). It happened that our common man wandered into the "check" or Torgsin by chance (Vladimir Vysotsky very funny told one of his songs about a similar story). The goods on the shelves were striking in their brightness and variety, the numbers on small plates seemed quite affordable, especially since no “dollar bugs” and other foreign symbols were indicated on the price tags. The attempt to buy something was suppressed by the question: “What is your currency?” The naive buyer timidly asked if it was possible to pay in rubles, to which he received an arrogant reply of the seller’s importance fulfilled: the price is indicated in arbitrary units. They explained to the slow-witted what u. e., after which they ashamedly left the Soviet store, where it was better for the citizens of the USSR not to go ...

At sea floating courses

After the introduction of the Jamaican monetary system in 1978, such an important component of world economic relations disappeared as a rigid linking of the leading monetary units to the gold content. In the financial ocean, among floating rates, those countries feel confident in which the stability of the purchasing power of the national currency is ensured by the well-being of macro-indicators (balance of payments, external and internal debt, gross product, etc.) Citizens of such states have no idea that is cu, they have enough of their own currency. Only the subjects of foreign trade and stock speculators are interested in the dollar exchange rate there. But this is as long as the size of inflation is within acceptable and reasonable limits. When prices begin to go up too quickly, the natural question arises of how to maintain savings, or rather, the ability to buy something in the future. People stubbornly strive for some kind of attachment, they need confidence in the future.

Dollar or Euro?

It is impossible to understand what cu is and to evaluate the meaning of this term in the life of the nineties without analyzing the economic situation of that era. The collapse of the Union was accompanied by the most unfortunate phenomena, including the rapid depreciation of the Soviet ruble. In employment, an important material incentive was the dollar salary, the size of which today seems ridiculous. However, these are the realities. The employee knew for sure that regardless of exchange rate fluctuations, the amount of goods that he could consume would remain relatively unchanged. Despite the fact that settlements on the territory of the country were carried out only in national currency, most prices for consumer goods (especially import ones) were indicated “in equivalent”. After the adoption of the common European currency, it became necessary to clarify what the conditional unit is - the dollar or the euro.

Prohibitions, regulations and ways out

The lack of confidence in the national monetary unit and the mass desire of citizens to keep savings in foreign currency indicate an unfavorable economic situation in the state. Moreover , a country suffering from this vice cannot be considered fully sovereign. The extreme manifestation of such a political situation may be the “freely joined territory” of Puerto Rico, whose citizens voluntarily abandoned their own monetary unit (the US dollar goes there) and other basic signs of state independence. Russia had every chance to become the same “banana republic”, despite the government decree issued in March 1993, designed to regulate the foreign exchange market and prohibit the circulation of foreign currency. Immediately, a simple but legally flawless way to avoid punishment for violating this legislative act appeared. As a rule, the transaction was as follows: the buyer in the mind (or using a calculator) converted the conventional units into rubles, the amount was written into the contract of sale (most often underestimated), and then the pale green money tied with an elastic band passed from hand to hand . No one usually bothered running around exchange offices.

Strength and weakness of the dollar. Hypothetical Conventional Unit of the Near Future

Many citizens, especially the elderly, were outraged by the dominance of the American currency. “Why is everyone so chasing after dollars, what kind of strength is in them?” They were surprised. “These papers are backed up by the economic and industrial power of the United States,” “educated economists” weightily explained to them. How fair is this today?

In recent decades, confidence in the dollar has declined significantly, despite the fact that it still serves as an international means of payment. The US financial system is suffering from serious economic problems, including an astronomical external debt, a huge budget deficit, and other consequences of "budget inflation." The prospects are added by the gloom and almost uncontrolled work of the Fed machines, printing money that is unsecured by real content.

It is possible that the time of “freely floating” exchange rates is coming to an end. The world economy again needs some kind of attachment. A new benchmark may soon be needed. Will it be gold again, another precious metal, or will the states agree that the conventional unit is a certain amount of energy consumed (for example, 1 gigacalorie or 100 kW / h)? Some economists are inclined to such options, and the assumptions about what the universal measure of the value of the future will be, converge on its energetic nature.