All innovations in the legislation take root with significant difficulties. A similar situation is observed with the delivery of such a document as the form of the CBA-K. About it are already legendary among personnel officers. Someone mentions the enormous queues and adamant inspectors of the PF, while others refute these horrors and say that reporting on the proposed order is not as difficult as it might seem at first glance. We will try to determine how things really are, and why now the documentation of SZV-K was required. The 2014 form is designed to clarify additional data on the

seniority of employees, which is not reflected in the archives of the Pension Fund of the Russian Federation for several reasons. All policyholders can fill out the necessary forms in the free Kontur.PF Report web application.

Introduction

The Pension Fund of the Russian Federation demanded that organizations of all forms of ownership provide before July 1, 2014 such documentation as the SZV-K form. The necessary clarifications apply only to employees, regarding whom the state regulator does not have information on labor activity until January 1, 2012. Corresponding instructions began to come to the company from mid-May and caused considerable unrest among personnel officers. Consider the reasons that prompted the Pension Fund to require the submission of such a report as the form of the SZV-K, and a number of clarifications from employers.

Why is FIU necessary?

In accordance with the Federal Law "On Insurance Pensions", which comes into force on January 2015, the procedure for calculating payments to citizens on loss of breadwinner, disability or old age has been adjusted. Their sizes will be determined taking into account many characteristics, but the key role in the numerical formation is given to the IPC. An individual pension coefficient is a parameter in which, with the help of relative units (points), pension rights are displayed that an employee or an insured person can apply for. Its final value is determined by a complex formula that takes into account the length of service, the amount of contributions paid and other specific characteristics. Among other things, to clarify and correctly display the

insurance period of an individual it is important to know the exact duration of the periods of other activities or work during which contributions to the Pension Fund were held. After clarifying the features, it becomes clear that there is a form of SZV-K, what it is, and what the purpose of the document is. However, it is important to clarify who needs to fill out these materials and what category of citizens they apply to.

Conditions

In the archive of the Pension Fund of the Russian Federation, data were found on individuals who paid insurance contributions on a regular basis, but did not have information about the features of their seniority until 2002. If these employees were registered with organizations as of December 31, 2013, then the companies received notifications demanding the provision of an up-to-date report with such a name as the SZV-K form. If the employee did not work until 2002 at all, then it is not necessary to draw up documentation for him, it is only enough to report this data to the competent organization. Whereas, upon termination of the employment contract between the employer and the staff after December 31, 2013, the policyholder is obliged to send the necessary information to the authorized body of the FIU of his region.

Report Preparation Methods

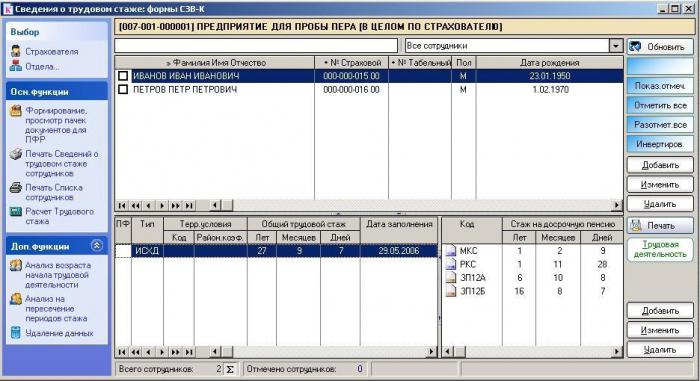

If you need to figure out how to fill out the SZV-K form, then special programs that are recommended for updating the data of an individual will help in this. In accordance with the requirements of the Pension Fund of the Russian Federation, they can be “Kontur. PF Report” or “1C”. To provide information on seniority by the end of December 2001, documents of the employee are required that confirm it.

Report Composition

Filling out the CPS-K form is carried out by all employers for their employees who have insurance certificates and were not dismissed at the time of reporting. According to the requirements of the FIU, organizations must group the materials necessary for the territorial authority into bundles. The following restrictions are imposed on them:

- The total size of the attached documents should not exceed 200 units.

- The various classes into which the SZV-K form is divided, the form with the list of employees, and other accompanying materials should be formed in separate bundles.

- Papers that are transferred to the Pension Fund must be accompanied by an inventory according to the approved form.

- Filling out the form CZV-K ends after it is numbered and fastened with a thread, which is displayed on the back of the packet and sealed with a paper sheet with the seal of the organization and indicating the number of pages.

Among other things, a brochure with a list of insured persons and the provision of information about them in any form is added to the pack. These papers are certified by the signature of the head and seal of the organization, which guarantees the correctness of the information displayed in them. In some cases, the documentation may be accompanied by a storage medium, however, all files that will be presented on it must comply with the “Rules for the preparation of personalized accounting” approved by the territorial authority of the FIU. Deviation from recommended standards is not allowed. If the form SZV-K, the form with explanations are made in several copies, then each such pack is assigned a serial number. Its indication is made on the inventory of reports that the employer submits to the Pension Fund of the Russian Federation.

In the future, this information will be entered into individual personal accounts of citizens and will be used to calculate seniority and determine the size of pension payments according to the new method. However, the accumulative system of contributions to the Pension Fund applies only to people who began working after January 1, 2012. At the same time, the rights of other persons with a sufficient amount of experience will not be infringed, their contributions will be converted in accordance with the new requirements of the regulatory legal acts of the Russian Federation. After all, it would be at least unfair to discount the period of many years of work, when an employee confirmed his rights to retirement day after day.

Grounds

The main evidence that confirms the experience of the employee may be various documents. The easiest way to track it is on the work book, but if there are no entries in it or there are inaccuracies, then they use the employment contract, extracts from the payroll statements and so on. In the event that the employee's activity was carried out in the form of civil law relations (paid services), written agreements between the employer and the employee are confirmation. The period of caring for children up to the age specified by law also requires the provision of evidence in the form of a baby's birth certificate. However, this experience can be counted towards one of the parents. Authorship is confirmed by contracts that are in writing and do not violate legal requirements. The time of receipt of unemployment benefits is determined by the relevant certificate from the employment service of the Russian Federation. Activities in the field of individual entrepreneurship are also recorded in such documentation as the form of SZV-K. The FIU requires to be guided when filling out the “Rules for calculating and confirming the insurance period for establishing a retirement pension”. As well as the recommendations of the authorities on the payment of mandatory payments.

Filling order

In order to submit the correct reports to the Pension Fund of the Russian Federation, it is necessary to figure out how to fill out the SZV-K form. This is a difficult process that requires not only attention, but also a sequence of actions. However, for its compilation there are instructions for personified accounting, which are designed to help in solving this problem. They contain specific recommendations for each case. Therefore, if we compare the sample filling out the SZV-K form, which is proposed in the standard position, with real examples of seniority, then on their joint basis we can prepare the correct documentation that does not cause questions in the PF.

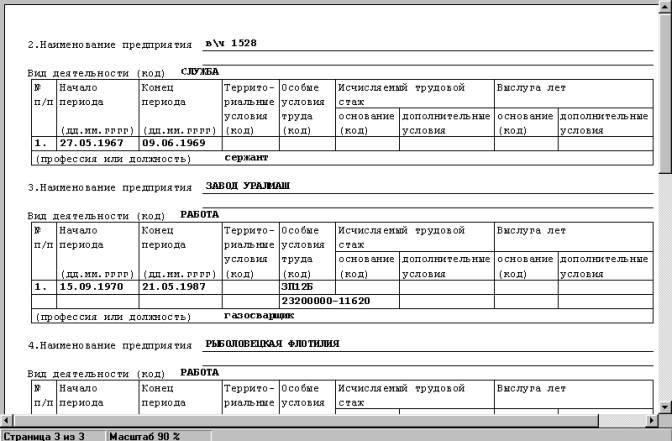

The completion of this report should begin with an indication of the employee's insurance number and his personal data. Name, surname, patronymic and date of birth are indicated on the basis of an identity card, civil or foreign passport and other identifying documents. The pension insurance number is determined from the relevant certificate. Also, the rules for filling out the SZV-K form provide for the indication of the territorial conditions of the employee's residence in a specific period of time. However, this clarification is made if an individual carried out labor activities in areas of the Far North, areas beyond the Arctic Circle or in territories equivalent to them. If the employee did not live in these conditions, then the section is not filled.

If the documentation (SZV-K form), the sample of which is determined individually, is filled out for the first time, then it is necessary to make an amendment that this is the initial report. If, after the delivery of this material, inaccuracies are found in it, then a correction sheet is drawn up, which is hemmed to the entire bundle. In the event that the data provided in the report does not correspond to reality, it is necessary to completely redo it, but already indicate the value “Cancel”.

In the column "Name of the organization" displays the name and ownership of the company or institution where the employee is currently engaged in labor activities. Whereas the section “Periods of social, labor or other activity” includes all employers until December 31, 2001. The code of the type of labor relationship is indicated in the column with the corresponding name, data is written according to the recommendations of the “Instructions for filling out personalized accounting forms”. If an employee applies for a preferential pension in connection with special conditions (work at heights, underground activities, harmful production, etc.), then the code of his profession is indicated. It is important to remember that such a sample filling in the SZV-K form is submitted to the PF separately from all documentation or in a stitched bundle with reports of the same type. Further paragraphs of materials for the Pension Fund are filled identically and will not cause difficulties. It is only necessary to be guided by the recommendations of the relevant instructions.

Sample Compilation

Consider the above example of filling out the CBA-K form on specific data:

- Ivanov Anton Ivanovich - name of the employee;

- July 14, 1985 - date of birth;

- Moscow, st. Vasilyevskaya, 12, apt. 6 - place of residence at the time of the compilation of the report;

- 009-480-671-93 - No. of compulsory pension insurance certificate;

- workbook entries contain the following data:

- From March 3, 1999 to December 20, 2002 he worked at Pulse OJSC as an engineer-technologist of tooling;

- From December 21, 2002 to the present, he has been working at Puls OJSC as a supply inspector. - Signatures and seals of responsible persons:

- Director of Puls OJSC Atorov Dmitry Vasilievich;

- Responsible person for the preparation of the SZV-K form - HR manager Vasenkova Taya Mitrofanovna.

Common problems

When filling out documentation for the Pension Fund, questions often arise about the need to include a full-time study period in the total number of years of service. Specialists recommend doing this only if the acquisition of education took place in a certified institution, its residency, graduate school and so on. At the same time, in the column “Name of organization” the full name of the university or college that has passed state accreditation and has the right to carry out its activities is displayed. If an employee studied at a military educational institution, then this period is equivalent to serving in the Armed Forces of the Russian Federation. However, if the work book does not contain data on education, then the employee can confirm his receipt with a certificate from the relevant university.

Penalties

What consequences will the organization expect to be late with the delivery of documentation such as the SZV-K form, what will this mean in practice for the employer? The Pension Fund offers the following interpretation of Law No. 27-FZ “On Personalized Accounting,” which will determine a fine of 10 percent of the total amount of contributions spent for the reporting time period. However, it is important to know that only a court can enforce the collection of these funds. And he, in turn, will apply laws that are more legitimate in this situation. More specifically, the regulatory act “On Compulsory Pension Insurance in the Russian Federation”. It contains provisions that require payment of only 1,000 rubles for violation of a certain term for reporting. Therefore, following the interpretation of the legislative framework from the PF is irrational, in this case most of the legal levers are on the side of the employer.

Despite all the difficulties that may arise during the preparation and submission of the CBA-K form to the Pension Fund, this document is very important, and you should not neglect its timely submission. To automate the preparation of this report, there are special programs that facilitate the processing of personal data of company employees. You just need to make sure that these applications comply with the current requirements of PF processing.