A liquid trap is a situation described by representatives of the Keynesian school of economics when cash injections into the banking system by the state cannot reduce the interest rate. That is, this is a separate case when monetary policy is ineffective. The main reason for the emergence of a liquid trap is considered negative consumer expectations, which make people save most of their income. This period is well characterized by “free” loans with almost zero interest rates, which in no way affect the price level.

Liquidity concept

Why do many people prefer to keep their savings in cash rather than buying, for example, real estate? It's all about liquidity. This economic term refers to the ability of assets to sell quickly at a price close to the market. An absolutely liquid asset is cash. You can immediately buy everything you need on them. Money in bank accounts has slightly less liquidity. The situation with bills and securities is already more complicated. In order to buy something, they first still need to be sold. And then we have to decide what is more important for us: to get as close to their market price as possible or to do everything quickly.

Next comes the receivables, stocks of goods and raw materials, machinery, equipment, buildings, structures, construction in progress. However, you need to understand that the money that is hidden at home under the mattress does not bring any income to its owner. They just lie and wait in the wings. But this is a necessary payment for their high liquidity. The level of risk is directly proportional to the amount of potential profit.

What is a liquid trap?

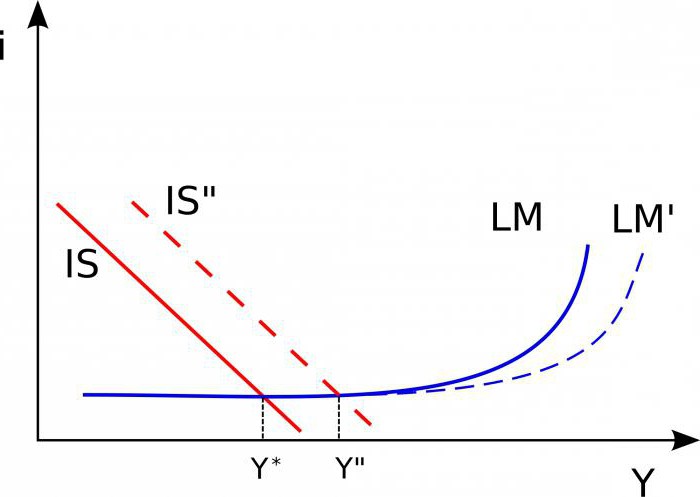

The original concept is associated with the phenomenon, which was expressed in the absence of a decrease in interest rates with an increase in the money supply in circulation. This is completely contrary to the IS-LM model of monetarists. Typically, central banks reduce interest rates in this way. They redeem bonds, creating an influx of new cash. Keynesians see here the weakness of monetary policy.

When a liquid trap arises, a further increase in cash in circulation has no effect on the economy. This situation is usually associated with a low interest on bonds, as a result of which they become equivalent to money. The population does not seek to satisfy their ever-growing needs, but to accumulate. This situation is usually associated with negative expectations in society. For example, in anticipation of a war or during a crisis.

Causes of occurrence

At the beginning of the Keynesian revolution in the 1930s and 1940s, various representatives of the neoclassical trend tried to minimize the influence of this situation. They argued that the liquid trap was not evidence of the inefficiency of monetary policy. In their opinion, the whole point of the latter is not to lower interest rates to stimulate the economy.

Don Patinkin and Lloyd Metzler drew attention to the existence of the so-called Pigou effect. The stock of real money, as scientists have proved, is an element of the function of aggregate demand for goods, so it will directly affect the investment curve. Therefore, monetary policy can stimulate the economy even when it is trapped in liquidity. Many economists deny the existence of the Pigou effect or talk about its insignificance.

Criticism concept

Some representatives of the Austrian school of economics reject Keynes's theory of the preference for liquid monetary assets. They draw attention to the fact that the lack of investment in a certain period is compensated by its excess in other time periods. Other schools of economics highlight the inability of central banks to stimulate a national economy with a low asset price. Scott Sumner generally opposes the idea of the existence of the situation in question.

Interest in the concept resumed after the global financial crisis, when some economists believed that direct injections of cash into households were necessary to improve the situation.

Investment trap

This situation is related to the one discussed above. The investment trap is expressed in the fact that the IS line on the chart occupies a completely perpendicular position. Therefore, shifting the LM curve cannot change real national income. Printing money and investing in this case is completely useless. This trap is due to the fact that the demand for investments can be completely inelastic at the interest rate. Eliminate it with the help of “property effect”.

In theory

Neoclassicists believed that an increase in the money supply still stimulates the economy. This is due to the fact that uninvested resources will someday be invested. Therefore, printing money in crisis situations is still necessary. This was the hope of the Bank of Japan in 2001, when it launched a “quantitative easing” policy.

The authorities of the USA and some European countries reasoned in the same way during the global financial crisis. They tried not to give out free loans and lower interest rates even more, but to stimulate the economy by other methods.

On practice

When Japan began a protracted period of stagnation, the concept of liquid trap again became relevant. Interest rates were almost zero. At that time, no one even knew that over time, banks in some Western countries would agree to lend $ 100 and get a smaller amount back. Keynesians considered low but positive interest rates. However, to date , economists are considering a liquidity trap in connection with the existence of what is called “free loans.” The interest rate on them is very close to zero. So there is a liquid trap.

An example of such a situation is the global financial crisis. During this period, interest rates on short-term loans in the USA and Europe were very close to zero. Economist Paul Krugman said the developed world is in a liquid trap. He noted that tripling the money supply in the United States from 2008 to 2011 had no significant effect on price levels.

Solution

The opinion that monetary policy at low interest rates cannot stimulate the economy is quite popular. He is defended by such well-known scientists as Paul Krugman, Gauti Eggertsson and Michael Woodford. However, Milton Friedman, the founder of monetarism, did not see any problem in low interest rates. He believed that the central bank should increase the supply of money even if they are equal to zero.

The government should continue to buy bonds. Friedman believed that central banks can always make consumers spend their savings and provoke inflation. He used the example of a plane that resets dollars. Households collect them and stack them in equal piles. This situation is also possible in real life. For example, a central bank can directly finance a budget deficit. I agree with this point of view and Willem Buiter. He believes that direct cash injections can always increase demand and inflation. Therefore, monetary policy cannot be considered ineffective even in a liquid trap.