“London fixing” is a phrase that quite often can be heard in analytical forecasts of the precious metals market. The financial procedure is known to all major players in world commodity markets; it has a significant impact on pricing in the framework of global precious metals trading.

What is fixing?

London fixing can be described as the process of determining the value of gold in the interbank London gold market. It is there that the foundations of supply and demand for metal are formed. Fixing is carried out twice a day throughout the working week. There is a daily price determination (AM fix) at 10.30 and an evening price determination (PM fix) at 15.00. For convenience, it was decided to navigate GMT. The cost of the precious metal during the procedure is set simultaneously in the three strongest currencies in the world: US dollar, pound sterling and euro. The price is fixed for one troy ounce.

The history of the process of determining the value of precious metals

London precious metals fixing was designed solely to fix and regulate contracts between participants in the London Bullion Market. Today it is generally accepted that fixing determines the maximum fair value of gold, which is subsequently used to sign contracts for the supply of this precious metal bullion. The fixed cost of an asset is oriented around the world, including pawnshops and jewelry production. The history of fixing the value of an asset began when in 1919 there was a devaluation of the pound. At that time, Rothschild received permission from the Central Bank of England to sell South African yellow metal. The bank had to determine the price of the asset, which would suit not only buyers in the market, but also sellers. So September 12, 1919 was the first London fixing. According to him, an ounce of gold was worth 4 pounds 18 shillings and 9 pence. In terms of the American currency of that time, it is $ 20.67.

Participants in the pricing process, or an excursion into the past

At the origins of fixation, the five largest dynasties of producers of the latter and its sellers took part in it:

- NM Rothschild & Sons.

- Pixley & Abell.

- Mocatta & Goldsmid.

- Sharps Wilkins.

- Samuel Montagu & Co.

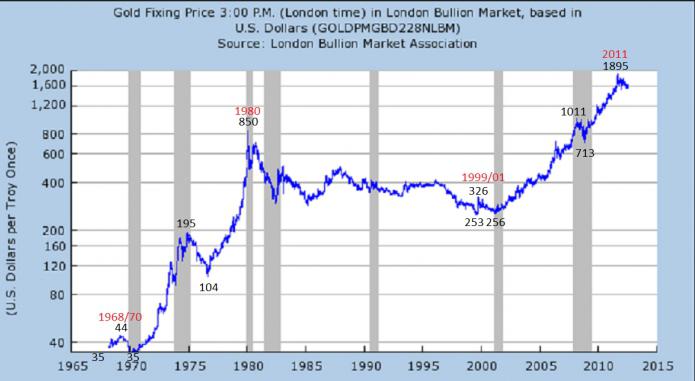

In the period from 1939 to 1954, the process was not carried out. This was directly related to the complete stoppage of the gold market during the Second World War. The largest jump in prices in the history of the process was recorded in 1980, when an ounce of gold was valued at $ 850. The increase in the price of an asset is associated not only with the unforeseen increase in the cost of oil on the world market, but is also related to inflation and the crisis in the Middle East. The highest price of gold, the London fixing which was determined on an official basis, took place in 2011, August 23. The price of the asset at that time reached 1,911.46 dollars per troy ounce.

Fixing and its participants

London fixing is a process of fixing the value of precious metals, which has some similarities with the auction. As the subject of the auction are Good Delivery bullion, whose weight is 400 troy ounces. The five largest banks participate in a kind of auction:

- Deutsche Bank.

- Société Générale.

- HSBC

- Scotia Mocatta.

- Barclays Capital.

Investors can take part in the auction, but only through dealers represented by the banks mentioned above. Representatives of financial institutions keep in touch with their banks during the process, and those, in turn, inform their own clients in real time. London fixing for gold begins with the chairman announcing the value of the metal, which is the most relevant at the moment. This price through the dealers is announced to bidders. In the opposite direction, information is received on how many sales and purchases are available in accordance with the indicated value of the asset.

Flexible partnership scheme

Each bidder has the right in his process to change his seller’s status to buyer’s status on the basis of supply and demand data - this is the feature that distinguishes London fixing. Silver, gold, platinum, palladium can either be bought or sold by process participants until the final announcement of the value of the latter. Not only the position of the participant is subject to change, but also the volume of his operation. The price of assets will rise and fall, depending on the volume of purchases and sales. A “swing” will take place until demand and supply are in a balanced state. The procedure takes from 5 to 40 minutes.

The longest fix in history was recorded on May 23, in 1990. Its duration was 2 hours 40 minutes, it coincided with the crisis in the Persian Gulf. To fix the final value of the asset, the difference between the offers of buyers and sellers should not be more than 50 bars. If during the bidding process it is not possible to fix the price, it is determined at the discretion of the chairmen and is called “fixing by will”. This situation is extremely rare.

How much do bidders pay for precious metals ?

Auction participants may be interested in a wide variety of precious metals: gold, palladium, silver, platinum. London fixing allows you to purchase an asset at the best possible price, as well as a sale. When the bidding is completed, their participants pay for the asset in accordance with existing applications. The seller of the metal receives a calculation at a fixed cost. Buyers of assets pay, in addition to the fixed price, 25 cents on top of each dollar. Silver buyers overpay 0.0025 cents in a similar pattern. Platinum buyers pay at a fixed price plus one more dollar. The gold exchange rate - London fixing determines it through bidding - is immediately announced to international news agencies that distribute it in all directions. The day fixation most effectively reflects the picture, since in the process of its implementation the markets of America, Africa, the Middle East and Europe are in full swing. The daily fix serves as a guide for all banks in the world in various countries.

Gold quotes not only in dollars, euros and pounds

London gold fixing sets the price of an ounce in euros, pounds and dollars. These quotes determine the development of the market, as they act as the most important fundamental indicators. An exception to the general rules for the formation of the value of gold are the Russian market, where an ounce of a precious metal is calculated in rubles, and the Shanghai Exchange, where a similar indicator is set in RMB. For investors from Russia and China, the analytical work is complicated, as they have to assess the situation not only on the London, New York and other exchanges, but also on the domestic market.

The situation in Russia

Today, in the unstable economic situation in Russia, fixing and its indicators have begun to play a big role for domestic investors. The depreciation of the ruble leads to the fact that people are showing more and more interest in the gold asset, which receives support due to the systematic depreciation of the national currency.

By the end of 2014, the purchase of a precious metal could be carried out at a price of 3055 rubles. Its sale was carried out at a price of 1465 rubles. This course is offered by the largest bank in the country - Sberbank. As demand from the residents of Russia for precious metals increases, quotations on exchanges paired with the ruble are growing. The trend has been holding for a long time, which allows you to set the price of an asset an order of magnitude higher than the fixing procedure determines. The difference between the fixing indicators and the actual price available to private investors is the income of dealers who carry out transactions with the asset directly during the fix.