Tenge is the national currency of Kazakhstan. It was introduced in November 1993, shortly after independence by the state. Kazakhstan, in which devaluation is a fairly frequent occurrence, is still considered one of the most successful post-Soviet states. And the monetary and financial system is taken as a model in other powers.

Title and Symbolism

The national currency of Kazakhstan is tenge. It was named after small Turkic coins. Dengue were silver. Their name was derived from the name of Russian coins. Half a penny was called money. In November 2006, Kazakhstan, in which the devaluation once again ended, held a tender for the tenge symbol. Out of 30 thousand works, one drawing was chosen. Its authors were Sanger Amerkhanov and Vadim Davidenko. For their work, they received one million tenge. At the old rate, this is about eight thousand American dollars. This amount was paid by the National Bank of Kazakhstan. An additional five thousand dollars was presented to the winners by the Alliance commercial financial union. However, after the publication of the work, a large-scale scandal erupted. It turned out that the drawing is no different from the symbol of the Japanese postal service. And he is already over 120 years old!

Brief information

In order to answer questions regarding how Kazakhstan is developing, whether there will be a devaluation of the tenge, you must first find out how this state was formed. Tenge was introduced later than most new national currencies in the post-Soviet space. In 1991, a group of designers was created to create banknotes. It was only in November 1993 that a presidential decree was issued on the introduction of its own national currency. Initially, the tenge against the Soviet ruble was equal to 1 in 500. In 1995, Kazakhstan opened its own factory to issue cash notes. Before that, coins were minted in Germany, and banknotes - in the UK. Then, Kazakhstan itself took up this directly.

Problem history

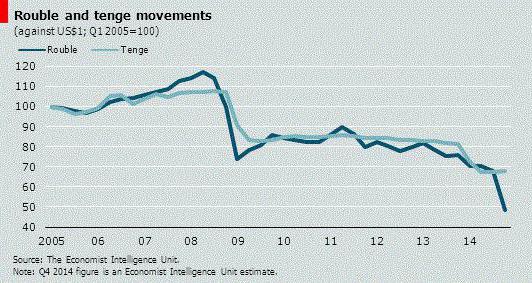

The devaluation occurred as early as April 1999. The National Bank reduced the rate of the national currency by 64%. The second crisis happened 10 years later. In Kazakhstan, there was a devaluation, the second in a row. The dollar exchange rate increased by 25 tenge. In 2014, the third tenge devaluation took place in Kazakhstan. The national currency depreciated by one fifth, or by 20%. But this measure was not enough. In the summer of 2015, the last devaluation took place in Kazakhstan. She depreciated the tenge by more than 35%. Since November of that year, a banknote with a face value of 20 thousand appeared in circulation.

National economy: basic information

The economy of Kazakhstan is the largest in Central Asia. In the post-Soviet space, it is second only to Russia. After 2010, Kazakhstan, in which the devaluation was carried out a year earlier, is an active member of the EAEU customs union. GDP per capita at purchasing power parity was 24 thousand US dollars. In 2014, the growth of this indicator amounted to 4.3%. The lion's share of GDP is provided by the services sector (57%) and industry (38%). The main industries are oil and gas, uranium, coal, non-ferrous and ferrous metals; engineering; construction; food sector. Exports in 2013 amounted to 83 billion US dollars. Its main article is oil and its derivatives. That is why such a small GDP growth is projected for 2015. If we talk about devaluation in Kazakhstan, then a drop in oil prices could be the main reason for its next round. Government debt is 12% of gross domestic product.

Prices in Kazakhstan after devaluation

The emergence of problems in the economy always leads to a decrease in the volume of construction. Employment of people is falling, which reduces their purchasing power. This leads to the fact that real estate prices in Kazakhstan are rapidly falling after devaluation. After the floating rate of tenge was established in the summer of 2015, the cost of housing decreased by 10%. All experts insist on one thing: the state should continue programs to help the population. Demand should stimulate supply. And in a crisis, only a state intervention can create such a situation.

Event Details

To date, the country has witnessed four stages of the crisis. The first tenge devaluation in Kazakhstan took place in April 1999. She depreciated the currency by more than 60%. The second devaluation occurred in 2009. The management of the National Bank did not use various methods of maintaining the currency. Reserves decided to maintain, and adjust the course. The third devaluation was observed in February 2014. It occurred against the backdrop of a sharp jump in the dollar and euro against the national currencies of the countries of the former Soviet Union. In Kazakhstan, a tenge fluctuation corridor was established (185 +/- 3 for $ 1). People were disappointed with this decision. At the beginning of the year, the government and the National Bank tried their best to convince the people that there would be no devaluation. After another round of currency depreciation, many exchangers and online stores suspended their work. Protests in front of the National Bank also began, and signatures were collected on the petitions website in favor of Nazarbayev’s resignation from the presidency. However, after the detention of several dozen protesters, all the unrest quickly ended.

Will there be devaluation in Kazakhstan

For some time after the rallies of the winter of 2014, everything calmed down. However, already in August 2015, a new stage of devaluation occurred. The National Bank of Kazakhstan released the tenge in free swimming. The main reason for the need for this step is the depreciation of the ruble. The Prime Minister of Kazakhstan immediately stated that this step was aimed at supporting industry. The new market tenge exchange rate, he said, will create the prerequisites for the restoration of economic growth by reducing inflation and creating additional jobs. But will devaluation continue in Kazakhstan? The forecast, unfortunately, seems disappointing. GDP growth in 2016 is expected to reach 1.3%, which is 5 times less than the average level for 5 years.

External debt

After the collapse of the USSR, Russia assumed the obligation to pay external debt. Other countries had the opportunity to start from scratch. However, as of March 2011, Kazakhstan’s debt amounted to 124 billion US dollars. About 6% of the amount is a state loan. At the end of 2008, the mentioned debt amounted to about 112 billion. Now it has grown - 150 billion US dollars. This means that for every citizen (including newborn babies) there are $ 8761 foreign loans.

Financial system

In 1998, Kazakhstan successfully passed a financial reform. To ensure sustainable development, the National Fund was established. Its goal is to reduce the state’s dependence on external factors. The country has 38 banks. State assets are concentrated in the Samruk-Kazyna holding. He supports commercial structures, redeeming their assets if necessary and creating subsidiaries. In the summer of 2015, the authorities decided to abandon the tenge currency corridor and switch to the inflation targeting policy. President Nursultan Nazarbayev said he will try to compensate for the loss to individuals who own deposits with the help of targeted savings at Zhilstroysberbank. The last straw for the economy of Kazakhstan was the weakening of the yuan. Government structures have long pondered the need to stabilize the tenge with the help of foreign exchange reserves. However, in August 2015, it was decided to switch to a floating rate. A further drop in oil influenced him. Deflationary expectations in the country are still very high, but there has not yet been a stir. Analysts say that individuals stocked up on currency, and some companies suspended their operations. Nursultan Nazarbayev stated that inflation targeting is a necessary measure, but there was no alternative.

Consequences of the financial crisis of 2007-2010

Of all the countries of Central Asia, the state under consideration is the most integrated in international economic relations. Therefore, the global financial crisis has found the greatest reflection here. In addition, Kazakhstan exports raw materials. It is very dependent on the price of oil and its derivatives in the world market. The underdevelopment of the stock market in the country has led to a sharp jump in property prices. And then the financial bubble burst, despite the custom-made forecasts of leading Kazakhstani specialists.

Trade sector

The traditional partners of Kazakhstan are the CIS countries and the Baltic states. They account for more than 60% of exports and imports. In 2013, foreign trade amounted to 132 billion US dollars. The main partner is the Russian Federation. Kazakhstan has historically developed close cooperative ties with it. From foreign countries, the main partners of the state are such countries: Great Britain, Germany, Italy, Turkey, USA, Czech Republic, Switzerland, Republic of Korea. Kazakhstan is trying to diversify its ties. The state is the main partner of India in Central Asia. Commodity turnover is constantly growing with the Russian Federation. Over 20 years of independence, it has more than doubled. Since July 2011, the Customs Union of Kazakhstan with Russia and Belarus began to operate. According to experts, this integration association can provide an additional 15% of GDP.

Export relations

The total value of goods exported from the country is 82.5 billion US dollars. The main export sectors are mining, fuel, metallurgical and chemical. The structure is dominated by raw materials. That is why the economy of Kazakhstan is so unstable. Oil and its derivatives account for 35% of exports, non-ferrous and ferrous metals - 33%, ores - 12%, grain - 9%.

Import

Kazakhstan imports into its territory raw materials, equipment, vehicles, mineral fuels and food products. After 2002, imports are constantly growing, especially for finished products.

Transport

Kazakhstan has a favorable geographical location. Therefore, he has good transport potential in the development of cargo transit. In 2007, Kazakhstan began jointly with Russia the construction of the Eurasia Canal, which was supposed to connect the Caspian Sea with the Azov Basin. In the case of the project, Kazakhstan wins significantly. It gets access to international seaports.

findings

Tenge is Europe's most depreciated national currency. According to economists, he devalued almost 2 times (by 85.2%). This is mainly due to external factors that the state could not influence in any way. However, already now this state of affairs is affecting the reduction in Kazakhstan's industry. Pressure on the economy provokes a decrease in the RMB and the ruble, as well as a sharp decline in oil prices. At the moment, the National Bank of Kazakhstan has released the tenge in free swimming. Whether such a measure will save the situation, time will tell.

However, according to the expectations of the Kazakh authorities, the economic situation is likely to develop according to a negative scenario. The Prime Minister even called on businessmen and ordinary citizens to begin to adapt to the new state of affairs. Over the next five years, the main export item of Kazakhstan (oil, as in the Russian Federation) will be kept at an average level - about 30-50 US dollars per barrel. The state needs to move away from the commodity orientation of trade. The development of the IT sector seems logical. There are also good opportunities for the development of mechanical engineering. If the state wants to develop dynamically, then it needs to get off the "oil needle". Otherwise, Kazakhstan, in which devaluation has already been observed four times, will be forced to depreciate its currency in the future.