The lifting of international sanctions from Iran has added another source of hydrocarbon supplies, the prices of which are already quite low. What can Iranian oil mean on the market for it, as well as for international and national oil companies operating in the Middle East?

Iran's potential

1976 was the best year for the country's oil industry. Iranian oil was stably produced in the amount of 6 million barrels per day, and in November of that year this figure reached an unprecedented 6.68 million. At that time, only Saudi Arabia, the Soviet Union and the United States were larger producers.

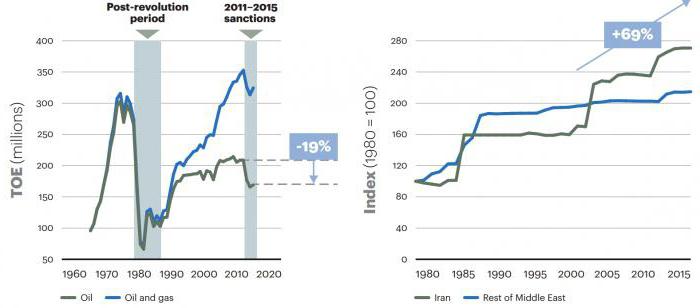

Then a revolution followed, and over the past 35 years, Iranian oil has never been extracted in excess of two-thirds of the peak of the mid-70s (although gas played a major role in this), despite the fact that the country's black gold reserves over the past 15 years increased by almost 70% - this is much higher than the neighbors over the same period.

Nevertheless, the experience of the 1970s is still a powerful reminder of what Iran’s oil industry is capable of after the lifting of sanctions.

Effective measures

The sanctions of the United States, the European Union and the UN, imposed on the country since 2011, have caused a significant reduction in oil production in Iran. They could not completely close the world markets, as some of the main consumers - India, China, Japan, South Korea and Turkey - continued to buy significant volumes of Iranian oil.

Nevertheless, the impact of the sanctions was significant. In particular, serious restrictions on technology imports led to a deterioration in the technical condition of production facilities, which also reduced the quality of Iranian oil. In addition, the expansion of the EU ban on tanker insurance imposed serious restrictions on the country's export potential, since more than 90% of global tanker fleet insurance is regulated by European law.

The end result was a significant reduction in hydrocarbon production, mainly due to unplanned shutdowns with a total loss of 18 to 20% of the potential production volume since the introduction of sanctions in 2011. Sanctions on Iranian oil reduced production by 0.8 million bpd, the amount that is now returning to the market.

Where does Iranian oil find its buyer?

After lifting restrictions in January, according to official figures, Iran sold four tankers (4 million barrels) to Europe, including French Total, Spanish Cepsa and Russian Litasco. This is equivalent to only about 5 days of sales at the level until 2012, when 800 thousand barrels per day were shipped to European customers. Many former large customers, including the Anglo-Dutch Shell, Italian Eni, Greek Hellenic Petroleum, and Vitol, Glencore, and Trafigura trading houses, are only about to resume operations. The lack of dollar settlements and the established sales mechanism in other currencies, as well as the reluctance of banks to provide letters of credit, became the main obstacles after the lifting of sanctions.

At the same time, some former large buyers note Tehran’s reluctance to ease its terms of sale four years ago and to show greater price flexibility, despite the excess of supply over demand and the seizure of the European market share of Iran by Saudi Arabia, Russia and Iraq.

Prospects for 2016

As the sanctions were lifted, the global oil market reversed in a bearish fashion, with prices dropping 25% between June and August 2015. At the same time, NYMEX futures continued to indicate a soft recovery, as some international agencies predicted July and August 2015, their stabilization at around $ 45-65 per barrel, similar to the price range from January to July 2015.

The further direction of movement of the hydrocarbon market largely depends on how much and how quickly Iranian oil exports increase after the lifting of the sanctions. There are two main opinions regarding this potential increase.

On the one hand, according to estimates by the International Energy Agency (EIA), Iran has the potential to increase production of about 800 thousand barrels per day, second only to Saudi Arabia. On the other hand, according to EIA forecasts, after the lifting of sanctions in early 2016, the supply of Iranian oil per year will increase by an average of 300 thousand barrels per day.

The main reason for such dissimilar estimates is that the latter gives more weight to the influence of several years of restrictions on the deterioration of the mining infrastructure of the Islamic Republic, which now needs some time to increase production. In the end, from the middle of 2012, due to unplanned stops, Iranian oil gradually began to be produced less by 600-800 thousand barrels per day.

How relevant are these production estimates for the modern global black gold market? An increase of 800 thousand barrels per day is about 1% of today's total global oil supply, which may be enough for sharp changes in cost in the face of fierce competition, but not for a glut of the market. More specifically, in the medium and long term, hydrocarbon prices tend to level off to the cost of producing the last barrel to meet demand. Long-term low cost of oil suppresses investment in the development of more costly fields; in the end, the wells are shut and supply is reduced. If the price rises above the limit, new investments bring additional, more expensive sources of hydrocarbons.

In this context, in relation to the shift in oil quotes in 2014, the current market has a less sensitive cost curve (since the most expensive developments are already profitable). Thus, a small source of cheaper supplies will have a much less impact on the price than under the harsh conditions of mid-2014.

As a result, the oil market model suggests that Iran should be able to increase production by an additional 800 thousand barrels per day in 2016. Quotes of the Brent brand in 2016, most likely, will continue to be in the range of $ 45-65 per barrel, which is consistent with the price corridor already observed throughout 2015.

What will happen in 3-5 years?

In the long run, however, the impact of Iran's return may be more significant. Over the past few years, we have witnessed a wave of discovery of new deposits well above the average in the Middle East. The country is not able to fully utilize these reserves due to limited access to the external flow of technology and experience. As a result, not only crude oil production fell, but the proven level of reserves is the highest in the history of the country. At the same time, current levels of production have not yet reached the level of coverage of government spending.

This, coupled with the fact that Iran (unlike Kuwait, Saudi Arabia and the UAE) does not have a sufficient investment fund to compensate for the budget deficit. This means that Iranian oil will be exported more, which, in turn, will depend on the ability of the state to use the necessary technologies and experience.

The regulatory framework of the Islamic Republic is also a serious problem for foreign companies wishing to invest money and know-how in the country's energy sector. Iran’s constitution prohibits foreign or private ownership of natural resources, and production sharing agreements are prohibited by law. MNCs and other foreign investors are only allowed to participate in exploration and production through buyback contracts. These contracts are essentially equivalent to service contracts, which allows outside investors to explore and develop hydrocarbon deposits, provided that after production begins, management will return to the National Iranian Oil Company or one of its subsidiaries, which may redeem the rights to pre-negotiated price. In 2014, the Iranian Ministry of Oil announced plans to introduce the so-called single oil contracts (IPCs), which operate as joint ventures or PSAs with a potential duration of 20 to 25 years (twice as long as the duration of the buyback contracts). If this new type of contract is allowed by law, the country's attractiveness as an investment target for MNCs and other international players will increase significantly and will lead to faster development of hydrocarbon reserves.

Prospects for Capital Investments

According to some estimates, new investments can increase oil exploration and production in Iran by 6% per year over the next five years (which is consistent with the growth rate in Iraq over the past few years), compared with an estimated 1.4% increase in oil production by The Middle East as a whole. In this scenario, assuming that demand remains the same, oil prices may vary between $ 60-80 per barrel by 2020, while in the absence of these events, ceteris paribus, the price may be 10-15% above.

In this price range, investments in higher-cost deposits such as shale, sandstone or shelf are unlikely to return to levels until 2014. Although production should continue as long as the cost of oil production remains low enough to justify the cost , the rapid exhaustion of such sources will reduce their significance (shale wells, in particular, typically produce 80% or more in the first 3-5 years). Under these conditions, additional volumes of Iranian oil entering the market will hit shale production in the United States, and slightly less on offshore fields in North and South America, Asia, Africa and the Russian Far East. And the rapid depletion of the North Sea will lead to their replacement by increased production in Iran and, potentially, in other countries such as Iraq and Libya.

Iranian oil and Russia

The poor quality of Russian Urals crude oil , which is delivered to Eastern Europe, causes increasing concern among consumers, as it leads to a decrease in the profitability of its refining and financial losses. So, the sulfur content in the oil delivered via the Druzhba pipeline and through the terminals in Primorsk and Ust-Luga exceeds 1.5%, and its density increased to 31⁰ API. This does not meet Platt's specification, according to which the sulfur content should not be more than 1.3%, and the density of the brand - not less than 32⁰.

With further deterioration in the quality of Russian raw materials, consumers in Europe will prefer other varieties - Kirkuk and Basrah Light or Iran Light. The quality of Iranian Iran Light is comparable to the Urals standard. The density of this brand is 33.1 ° API, and the sulfur content does not exceed 1.5%.

The lifting of sanctions from the Islamic Republic requires international and national oil companies in the region to review their strategic plans and take into account the challenges and opportunities of the following scenarios.

Foreign investment

Iranian oil in the world market opens up a wide range of potential opportunities for MNCs and other foreign investors, especially with the approval of new IPC contracts. After several years of limited access to external technology and the experience of the Iranian mining industry, outside assistance will be required, and the state of the country's finances suggests that it is in its interests to remove all obstacles to quickly receive this assistance.

In addition, while production will come first, a similar situation may arise with transportation (pipelines for exporting growing production volumes), chemicals (gas-chemical cracking for producing olefins for export), and refining (to replace equipment for oil refining which has not been modernized during the course of the sanctions).

Prior to the imposition of restrictions, Iran was a major importer of petroleum products, so refining capacities can now be expanded to meet local demand, in part due to the low ryal exchange rate that facilitates import substitution.

Oil production in Iran and Iraq is growing, and with the stabilization of the political situation, it is planned to increase it in Libya, which is likely to strengthen and extend the current scenario of cheap oil. There are a number of strategies that will allow NOCs to mitigate the effects of this.

Exploration and production

Opportunities for reducing costs and improving efficiency, in particular those associated with oilfield services, contractors, and other external costs, are available. With the low price of hydrocarbons, global investment in exploration and production of high-cost deposits is slowing down, service companies have an excess of production capacities, and they become much more open to revising their rates downward. In addition, when key products such as iron ore are now quoted at historic lows, significant cost reductions can be achieved through material management. For Middle Eastern NOCs, whose stocks are still cheap enough to warrant continued investment, a focus on improving supply represents a real opportunity to significantly reduce costs without attracting real investment.

Recycling

Inexpensive raw materials also mean low cost products of its processing. Since gas is typically supplied more locally, the cost of petroleum products correlates with the price of crude oil.

This means that in conditions of falling demand, quotes for oil products are reduced faster than for gas. At the same time, if Iran enters the market with additional gas cracking plants, which are relatively easy to put on stream to use the growing gas production, this will put more price pressure. Indeed, given that the country does not have export LNG facilities (and it may take years to build it), the opportunities for profit from surplus gas come down to either building new pipelines (for example, the one that connects Turkey, Armenia and Azerbaijan today), or to gas processing. Iran is already actively using the latter option, while planning additional gas pipelines to meet the raw material needs of new petrochemical plants in the west of the country. For example, the construction of 1,500 km of the Western Ethylene Pipeline is in its final stages. This, combined with the low operating costs of Iranian installations, is likely to make the Islamic Republic a producer with the lowest quotes for light olefins.

It also means that the combined price of petroleum products will expand the use of catalytic cracking. Iran’s return to the market will require a review of the comparative profitability of hydrocarbon-based products, and the Persian Gulf gas producing countries may reach the comparative profitability of exporting gas in the form of LNG compared to its processing into olefins.

Just as cheap fractions are good for cracking, cheap crude Iranian oil on the market is good for refiners. This will lead to additional investment opportunities in the Persian Gulf - several projects are already underway to increase throughput (without taking into account the downstream expansion that could take place in Iran). In a situation where financially difficult MNCs and independent companies in other parts of the world are trying to get rid of their own processing assets, Middle Eastern NOCs have a chance to carry out attractive mergers and acquisitions.

The lifting of sanctions from the Islamic Republic and the associated increase in hydrocarbon supplies lead to the conclusion that the world, as in 1980, is at the beginning of a potentially long period of low oil prices. The Iranian perspective offers new challenges and opportunities, and it belongs to those who quickly and effectively put this changing dynamic into their strategic plans.