The General Theory of Employment, Interest, and Money was written by British economist John Maynard Keynes. This book became his magnum opus. The author of the "General Theory of Employment, Interest, and Money" was the first to determine the form and list of terms of modern macroeconomics. After the publication of the work in February 1936, the so-called Keynesian revolution took place. Many economists have moved away from the classical belief that the market can independently recover full employment after temporary shocks. For the first time, such well-known concepts as multiplier, consumer function, marginal capital productivity, effective demand and liquidity preference were presented for the first time in the book.

John Maynard Keynes at a Glance

The future founder of modern macroeconomics was born in 1883 in the city of Cambridge. His ideas were destined to fundamentally change the theory and practice of making state decisions in the economic field. John Maynard Keynes is considered one of the most influential scientists of the 20th century. He refuted the postulate of the classical theory of the effectiveness of the "invisible hand" of the market. Keynes concluded that the overall level of economic activity is determined by aggregate demand. Therefore, it is precisely on the latter that the state should focus as the main regulator, whose task is to soften business cycles. After the Second World War, almost all developed countries built their policies in accordance with Keynesian views. Interest in this area began to weaken in the 1970s due to the inability to control high inflation rates. However, after the financial crisis of 2007-2008. many countries began to return to Keynesian methods of regulation and active government intervention in the national economy, as Keynes bequeathed. "The general theory of employment, interest and money" is considered the main work of the scientist. It contains all the basic terms and models of this area.

The General Theory of Employment, Interest, and Money: Book

Keynes magnum opus main idea is that the unemployment rate is determined not by the price of labor, as neoclassicists see, but by aggregate demand. The founder of macroeconomics believed that full employment could not be provided exclusively by market mechanisms. Therefore, the intervention of a third force, that is, the state, is necessary. The work “The General Theory of Employment, Interest and Money” explains that underutilization of production capacities and underinvestment is a natural state of affairs in a market economy, which is regulated exclusively by an “invisible hand”. The scientist argues that the lack of competition is not the main problem, sometimes even a decrease in salaries does not create additional vacancies. Keynes praised his book from the very beginning. He believed that she could turn upside down all traditional views. In a letter to his friend Bernard Shaw in 1935, John Keynes wrote: “I believe that I am writing a book on economic theory, which will be a big breakthrough - of course, not immediately, but over the next ten years - in how the world decides emerging economic problems. " This fundamental work consists of 6 books (volumes), or 24 chapters.

Foreword

The “General Theory of Employment, Interest, and Money” immediately came out in four languages: English, German, Japanese, and French. Keynes wrote a preface to each of the publications. The emphasis in them was placed a little differently. In the English edition, Keynes advises his work to all economists, but expresses the hope that it will be useful to everyone who reads it. He also notes, albeit not obvious at first glance, but still the relationship between her and his other book, written five years earlier - "A treatise on money."

Introduction

What is the work "General theory of employment, interest and money"? Briefly its essence can be described as follows: demand creates supply, the reverse situation is impossible. The first chapter takes only half a page. There are three sections in this volume:

- "General theory."

- "Postulates of the classical economy."

- "The principle of effective demand."

In the above sections, Keynes explains why he believes that this book can change the way economists think about the functioning of the economy. He says that the title of the work was specially chosen to emphasize the differences with the classical theory, the application of the conclusions of which is effective only in individual cases, and not always.

Book II: “Definitions and Ideas”

It consists of four chapters:

- "The choice of units."

- “Expectations as the Determinants of Production and Employment.”

- "Definition of income, savings and investment."

- "A more complete consideration."

"Addiction to consumption"

The third volume explains the essence of consumption and describes how it stimulates economic activity. Keynes believes that during a depression, the government needs to restart the “engine” at an additional cost. This book includes three chapters:

- "Objective factors."

- "Subjective determinants."

- "Marginal propensity to consume and multiplier."

According to Keynes, the market does not have the ability to self-regulate. He did not believe that full employment was a natural state that would necessarily be established in the long run. Therefore, state intervention is so important. Economic growth, according to Keynesianism, is entirely dependent on competent fiscal and monetary policies.

"Motivation to invest"

Marginal productivity of capital is the ratio between potential income and its initial value. Keynes equates it to the discount rate. The fourth book consists of 10 chapters:

- "Marginal capital productivity."

- "The state of long-term expectations."

- "General theory of interest."

- "Classical theory."

- "Psychological and business incentives for liquidity."

- "Various observations on the nature of capital."

- "Fundamental properties of interest and money."

- "General Theory of Employment, Re-Formulated."

- "The function of unemployment."

- "Price Theory."

“Brief notes”

The outstanding macroeconomic work (“The General Theory of Employment, Interest and Money”) is completed by the author’s comments in three chapters:

- "On the trading cycle."

- "On mercantilism, usurious laws, stamped money and theories of underconsumption."

- “On social philosophy.

In the final chapter, Keynes writes: “... the ideas of economists and political philosophers, regardless of whether they are right, are much more influential than is usually thought. Indeed, the world is governed somewhat differently. Practical people who consider themselves completely independent of the thoughts of scientists are usually slaves of some deceased economists. The madmen in power extract their ideas from last year’s articles of some scribblers from the world of science. I am sure that the power of selfish interests is significantly exaggerated compared with the gradual spread of the influence of ideas. Of course, not immediately, but after a certain period of time; in economics and political philosophy, ideas can influence theories even in 25-30 years. And these are ideas, not selfish interests, that are dangerous on the path to prosperity or unhappiness. ”

Support and criticism

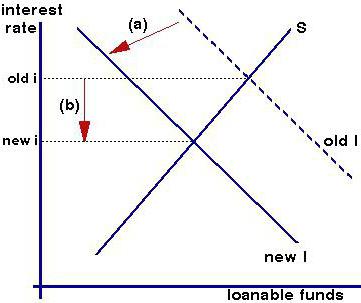

The “General Theory of Employment, Interest, and Money" does not contain detailed guidance on managing the economy. However, Keynes has shown in practice how the reduction of long-term interest rates and reforms in the international monetary system affect investment and consumption by the private sector. Paul Samuelson wittily said that Keynesianism “struck many young economists as an unexpected new disease attacks and exterminates an isolated tribe of islanders in the South Sea.”

From the very beginning, “The General Theory of Employment, Interest, and Money” has been quite controversial work. No one knew exactly what Keynes had in mind. The first reviewers were very critical. Keynesianism owes much of its success to the so-called "neoclassical synthesis" and in particular to Alvin Hansen, Paul Samuelson and John Hicks. It was they who developed a clear explanation of the theory of aggregate demand. Hansen and Samuelson came up with the Keynesian Cross, and Hicks created the IS-LM (Investment Savings) Model. Widespread "General Theory" received after the Great Depression. The market could not cope with shocks on its own, so state intervention seemed inevitable.

On practice

Many of the innovations first proposed in the General Theory remain key in modern macroeconomics. However, the main idea that the reason for the recession is insufficient aggregate demand has not taken root. The university courses now mainly teach the so-called new Keynesian economics. She accepts the neoclassical concepts of long-term equilibrium. Neo-Keynesians do not find General Theory useful for further study. However, many economists still consider it significant. In 2011, the book was included in the list of the best contemporary non-fiction.

Use in the study of economics

The first attempt to adapt the "General Theory" for students was Robinson's textbook, published in 1937. However, the most successful leadership was Hansen. A more modern textbook was released in 2006 by Hayes. Then came the simplified version written by Sheehan. Paul Krugman became the author of the introduction to the new edition of Keynes' General Theory, published in 2007. However, the original source is gradually losing its significance. It is generally accepted among economists today that it is possible to regulate the economy using aggregate demand only in the short term, and for a longer period of time, equilibrium can be established independently using market mechanisms.