Many people perceive the profession of accountant as just working with numbers. In part, they are right, but this is far from the only mission of this specialist. The responsibilities of these employees may include maintaining records, interacting with government officials, and more.

In general, the accountant usually optimizes the financial work of the company and checks the compliance of its business with current legislation. In our country, specialists of this type control the financial flows in the organization, draw up all related documentation and report to the competent authorities. The employee is primarily required to be able to minimize company expenses. All necessary data are entered in the job description of the chief accountant.

Requirements for Specialists

Today, many can obtain the necessary skills of the profession without having a higher education. The main thing is ambition, knowledge of this field, as well as the completion of specialized courses. But in order to stay afloat, you need to be aware of all the changes, constantly study and improve your skills.

What exactly will be needed from a particular employee depends on the organization itself, its direction and scale. Of course, there is general knowledge necessary for all representatives of this profession - these are statistics, financial management, credit relations, reporting rules, business activities, planning and much more. If you want growth on the career ladder, then, as the job description of the deputy chief accountant claims, you still have to get a higher education.

Provisions

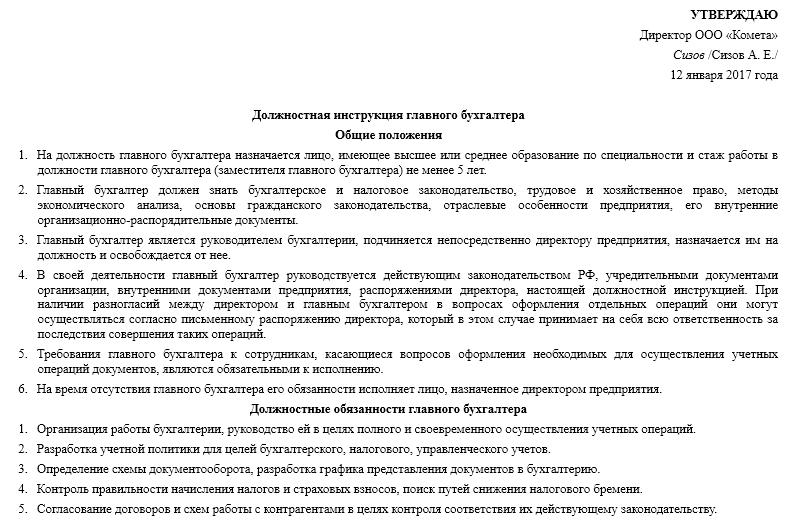

The specialist who is accepted for the position is the head, and only the general director can decide on his admission or dismissal. The employee is directly subordinate to two managers: financial and chief directors. As indicated in the sample job description, the deputy chief accountant, at the time of his absence, appoints senior management of the company. This employee is vested with the rights and duties corresponding to the position being replaced.

In his activities, the employee must be guided by the laws of the country, the charter of the enterprise, its rules, orders of the authorities and the job description of the chief accountant of the institution. Only a specialist with higher professional education can get this job. Moreover, experience in accounting and finance is also important - at least five years. It is important to note that the experience gained in managerial positions is also taken into account.

Knowledge

The job description of the chief accountant establishes that, entering this position, the employee has certain knowledge. He must confirm that he is well versed in the legislation regarding the scope of accounting, is familiar with the basics of civil law and knows the tax, financial and business laws. The employee must study all the regulatory and methodological documentation that governs the accounting and financial and economic activities of the company.

And also to get acquainted with the instructions and requirements of the organization of accounting, to delve into the features of its management in the organization where he is employed. The knowledge of the person accepted for the position includes codes of accounting and professional ethics. He must familiarize himself with the profile, structure and specialization of the enterprise, find out its development prospects and the strategy used for this. To have statistical and tax accounting, it is mandatory to have managerial skills.

Additional knowledge

The job description of the chief accountant obliges the employee to know the procedure for processing accounting operations and document management. It means that he has knowledge of accounting: correctly write off shortfalls, debts, other losses from the account. He knows how the acceptance, storage, posting and expenditure of financial resources, material assets and the reflection of other production and economic activities of the company are conducted.

And also the employee should be familiar with the rules for conducting audits; own the order and forms of payments, monitor changes in the terms of taxation of individuals and legal entities. Competently carry out inventories, both of commodity, material values, and monetary resources. Be able to timely make settlements with creditors and debtors, carry out inspections and audits.

Extra skills

The job description of the chief accountant is based on his knowledge of the procedure and timing of the preparation of balances and reports in the accounting field. In addition, it takes into account that the employee understands modern information and reference systems in the field of financial management and accounting. Knows the rules for protecting information and storing important documentation. In addition, he studies the best practices of his country and other countries related to his activities. The employee is also required to own the specifics of the company’s work, economy, personnel management, production technology, legislation and apply his knowledge depending on the direction of the organization where he is employed.

Functions

The job description of the chief accountant of the LLC establishes that he manages the organization of work on setting and maintaining records in the company. This is done so that all interested internal and external users can receive complete and reliable information. The information relates to the economic and financial activities of the company, as well as its financial situation. He is engaged in the formation of the accounting policies of the company, in accordance with applicable law.

It is based in its work on the specifics of the business environment, size, structure, as well as the organization’s affiliation with a particular industry and other company features. This is necessary for the timely provision of data to management, on the basis of which planning, analysis, control, assessment of the financial situation and the result of the organization’s activities will be carried out.

Responsibilities

The job description of the chief accountant of a budgetary institution obliges an employee to lead certain work. Among them, it is worth highlighting the preparation and approval of a work plan, ensuring the procedure for taking inventories, internal control and ensuring the protection of information. The chief accountant provides guidance on the compilation of data for the accounting information system, monitors their compliance with the norms and standards considered in the legislation, and ensures the correctness of data for internal and external users.

He is engaged in the organization of work on register maintenance, based on the use of modern technologies. It provides control over the timely entry into the enterprise database of all information regarding business transactions, expenses, income, fulfilled obligations, and the correctness of registration of primary accounting documentation.

Additional functions

The job descriptions of the chief accountant of a budgetary institution suggest that he is engaged in organizing information support for accounting, making cost estimates for the products or services that the company is engaged in, as well as creating internal management reports. It is this employee who ensures that all accrued taxes and fees are paid to state budgets in a timely manner, insurance premiums and payments are made in a timely manner, and controls the financing and repayment of debts. In addition, it provides accounting for labor costs, the correctness of the formation of accrual of payments.

It makes sure that the schedule of inventories is respected and that they are carried out in accordance with established norms and procedures, as well as all documentation on them has been drawn up correctly. The employee participates in the financial analysis of the organization and the formation of tax policy, based on the accounting records and the results of the internal audit. Also, the chief accountant is involved in the development of methods and directions for improving the financial activities of the company, measures to eliminate losses and costs. Including those that do not relate to production costs.

Other duties

The job description of the chief accountant of the enterprise entrusts the employee with the obligation to ensure compliance with cash and financial discipline. It means that it controls the accuracy and correctness of the compilation of expenditure estimates, verifies the legality of accounting activities. He takes part in the drafting of acts relating to the illegal expenditure of company funds or its commodity and material values. If necessary, he must ensure that all materials are transferred to the appropriate judicial and investigative authorities.

Other tasks

A sample of the job description of the chief accountant of an LLC may include tasks such as ensuring that all necessary reporting documents are compiled, including estimates, statistics, and accounting. He also controls her transfer to the relevant government agencies. The employee monitors the safety of important documents and organizes the functioning of the archive. His responsibilities may include the provision of methodological assistance to department heads and their subordinates if their questions relate to his direct activities. He manages the accounting department, is engaged in continuing education for his subordinates.

The rights

The job description of the chief accountant according to the Professional Standard determines that the employee has the right to establish official duties for his subordinates. He also has the right to establish the procedure for documentation and the transfer of information regarding financial transactions in all divisions of the company. He has the right to endorse the dismissal, appointment, transfer of financially responsible employees, and is also obliged to verify and sign agreements and contracts concluded by the company.

The employee has the right to require the management of the company and its employees to take measures aimed at strengthening the safety of property, as well as ensure the correct organization of accounting data. He can check whether the organization’s departments comply with the established procedure for the receipt, posting, storage and use of the company's financial, commodity and material resources. It has the right to represent the accounting department of the company and act on its behalf in other organizations. In addition, he has the right to propose activities aimed at improving the activities of the department of the enterprise subordinate to him.

Responsibility

Sample job description chapters. the accountant indicates that he is responsible for the negligent performance of his duties or the complete absence of tasks. They may also be blamed for late payments in cash or non-cash. He will be held accountable for non-compliance with applicable laws, financial and cash discipline, technology and the timing of data processing and the procedure for circulation of documentation.

The chief accountant is responsible for:

- for the legality of debiting shortages, debts and other expenses from the company's accounts;

- for the safety of documentation, the correctness of its design and timely delivery to the archive;

- for failure to fulfill key performance indicators of the organization;

- for non-compliance with instructions, violation of trade secrets and disclosure of confidential information.

- for causing the company material losses, the use of their powers for personal purposes or their excess.