On November 14, 2139, the prison sentence of the famous American businessman, convicted of a scam, will come to an end. In the recent past, he was considered one of the most successful businessmen not only in the United States, but throughout the world, and was chairman of the Board of Directors of NASDAQ (Stock Exchange).

Probably everyone who has any interest in economics and finance has heard about him. Bernard Madoff? Yes, it is he. The world has not yet met a fraudster of this magnitude. What kind of brain do you need in order to come up with such a great scam ?! In more detail about what the financial pyramid of Bernard Madoff was, who exposed him, and also about many other things read in our article.

Case history

In the early summer of 2009, an American “entrepreneur,” or rather, a brilliant fraudster who was believed by more than 3 million people around the world, was sentenced to 150 years in prison for creating the largest financial pyramid in America’s history - a bubble, which eventually burst. The damage to people who believed him is estimated at more than 64 billion US dollars. By the time the verdict was passed, Bernard Madoff was already 71 years old. Of course, it’s ridiculous to sentence an elderly person to 150 years in prison, but this is American justice. By the way, there is information that he is a cancer patient. Naturally, if a miracle does not happen, the fraudster-entrepreneur will never see freedom again. However, he does not despair. Even while in prison, he managed to crank out another scam, though not on the same scale as his "ingenious" pyramid: he bought all the cocoa that was sold in a local buffet, and resold it at the highest possible price. Such is he, and enterprise is the main feature of his character.

Biography

He was born in 1938 in a family of Jewish immigrants who came to America. Bernie's father (as he was called from childhood) Ralph Madoff was a plumber, but had a great passion for money and earned money on one of the stock exchanges. The mother of the future entrepreneur did not do anything special, she ran a household and raised children, however, like most Jewish wives living in the New World. A few months before the birth of his son, his father became more seriously engaged in financial activities. He wanted at all costs to get out of poverty. In the same year, the acute phase of the Great Depression began in the country, and he was left without work. So the “games” on the exchange were his only income, although they did not bring him any serious profit. But Ralph did not despair and founded his own business selling sports goods. However, this business was not successful either: by the time his son went to school, the company went bankrupt. Unlike Madoff Sr., Jr. in the future became a more successful businessman, but more on that later.

Childhood

At school, little Bernie did not stand out among the other students. His family lived in cramped conditions, but he was little interested in the financial problems of his parents. As a teenager, being an excellent swimmer, a member of the school team in this sport, she decided to work as a lifeguard on the beach in order to have her own money. He was arranged there by his swimming coach. Even then, Bernard Madoff, whose scam in the future shocked the whole world, did not like wasting money and was saving it for future investments.

Adulthood

After school, he went to college and began to study as a political scientist. Back in his studies, Burney met a beautiful Jewish girl from a fairly wealthy Ruth Alpern family. They got engaged in 1959, then they got married and began to live together until 2009 (as much as 50 years!), When the great con man was arrested. In the same year, having received a bachelor's degree, he continued his studies at the Brooklyn School of Law. But here he did not stay long. A year after that, I decided to quit classes and set off for free swimming.

First business

During his life as a lifeguard, he managed to save 5 thousand dollars. However, this was not enough to establish their own business. He borrowed $ 50,000 from his spouse's relatives and founded his first investment company, calling it Bernard L. Madoff ("Bernard Madoff L"). His father-in-law, Sol Alpern, who was a financial consultant, not only supported his son-in-law with funds, but also brought his first clients to him. Convincing his former companions and acquaintances of his son-in-law's talents in matters of financial investments, he helped him a lot. They went around the stock exchange and invested in the Pink Sheets outside of it. It was profitable, but Madoff did not have the opportunity to compete.

A modern approach to business management

Nevertheless, Bernie found a way out and by 1980, Investment Securities LLC became one of the largest (if not the largest) of the largest traders in New York. 5% of all transactions completed on the New York Stock Exchange were carried out by this company. Such a leap was made possible by computerization. Bernard Madoff's company was one of the first to use the electronic trading format. Meanwhile, their competitors still continued to send their employees to the stock exchange. After modern technologies passed all the tests, they became the basis for the NASDAQ fund - the Bernard Madoff pyramid.

The beginning of a scam

A moment came when people entrusted to the ingenious swindler their finances totaling $ 50 billion. And then he decided to crank out the biggest fraud in the history of the country. By the way, he later admitted that he did not consider himself guilty, since he did not persuade anyone and did not deceive anyone. People themselves “threw billions” in his face in the hope of increasing their income. After all, they were not crazy and were not born today, they should have understood that something was wrong here. But for some reason everyone liked to be deceived and not go deep into the essence. It seemed to everyone that Madoff possessed some special knowledge, thanks to which he was able to generate such great profits. Sometimes clients came across who nevertheless began to suspect something was amiss, and then Bernard Madoff - a fraudster and a clever swindler, without a moment's hesitation, offered them to take their money. But they could not resist the temptation to earn millions, as well as the magnetism of the great “entrepreneur,” and left their funds with him. Bernard Madoff in an interview with New York magazine tells how difficult it was for him to keep this secret with him. He admitted that this was a real nightmare. He foresaw the trouble, but could not share it with anyone: neither his wife, with whom they had lived 50 years, nor his sons ... And even to his brother - his best friend - he did not tell anything.

Bernard Madoff: a scam that surprised the whole world

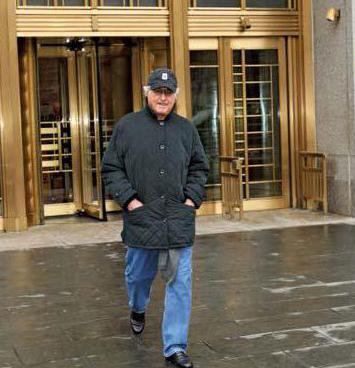

Surely, many have heard about the founder of the Nasdak exchange ( NASDAQ National Market (NNM)) and his fraud. Judging by how he managed to crank up his scam, he can be called a stock market guru. It is incomprehensible to the mind how he was able to deceive investors from all over the world. The amount by which he was able to “untwist” them, amounted to more than 60 billion US dollars. This money has disappeared unclear where. The world has never seen such a scam, and Bernard Madoff, whose photo you see in the article, was recognized by the public as the most inventive fraudster in the history of the United States. To carry out this scam, he used the most ordinary Ponzi pyramid. He disguised her as a hedge fund. This was a very simple, but at the same time complex scheme. Since he was known as a successful stock market trader since 1960, people trusted him with their money, believing that his brain is able to comprehend what others cannot.

Why did people believe him?

What factors made the scam possible? This is, first of all:

1. The impeccable reputation of a businessman and a wide range of his acquaintances. Even in those days when for many computer technologies seemed incomprehensible, he used them for trading, as well as analysis. The fact that he began to use them in his work raised his authority. And many of his colleagues considered him the owner of extraordinary abilities and extraordinary thinking. And the pyramid of Bernard Madoff was not entirely clear to many of the investors, but they sincerely believed that the entrepreneur probably knew what he was doing. After all, he has such a reputation!

2. Secrecy was also of particular importance to the prosperity of the Madoff scam. He was able to masterfully mask his transactions, and published an investment strategy in a general way. He urged his investors not to talk about what the fund was doing, supposedly for their own good. That is why for the time being no one has noticed the weaknesses of Bernie's investment strategy. Some experts felt that something was wrong here, but could not find any evidence.

3. Madoff was considered a great authority in the Jewish diaspora. It was in this environment that he found new partners and investors. Among them were billionaires, large entrepreneurs who were not averse to increase their funds, presidents of venture funds, chairmen of the board of directors of the world's largest world banks. Jewish communities prefer to invest in the projects of their members, rather than representatives of other nationalities.

4. The amount of dividends was small - an average of 12% per annum, and there were never any problems with paying interest.

Exposure

The first person to suspect Madoff of fraud and noticed something was wrong was Gary Markopoulos, a financial analyst. His calculations, sent to the Commission on exchanges and securities, were ignored. Moreover, he did this not once, but as many as four times - in 2000, 2001, 2005, and in 2007. They have never listened to him. He was the first to notice: either the calculations are incorrect, or the activities of the fund are invalid. Later, after Madoff was exposed, he published a book about his futile attempts to reach out to members of the commission. It was called "No One Would Listen".

In 2000, Bernie was offered to sell his fund for a billion dollars. However, he refused. Everyone who knew about it was shocked and could not understand the reasons for the refusal. However, he explained to them that the campaign was doing as well as ever, and he wanted to take it to a different level. In fact, Bernard Madoff, whose biography is of genuine interest to the younger generation, was afraid that checks would be carried out before the act of sale, and this he could not allow. After all, then the deception would be revealed. This was also surprising for Marcopoulos; therefore, he set about his calculations and discovered what was hiding from others. Two years later, the amount of interest that Bernie had to pay investors grew to incredible proportions, and then the great con man began to panic. Of course, he tried to find more and more new investors, but their investments could not cover the necessary amounts. Nevertheless, he managed to hold out until 2008. His stock market crashed. The moment came to a climax, and Bernie's sons noticed that something was wrong with their father. When they found out what their father had done, they turned him over to the authorities. There was no other way. Indeed, deceived customers were breaking in their doors and demanding their money. As a result, it became known that the last 13 years, that is, since 1997, Madoff Sr. has not been involved in any investments at all.

Court

The testimony of a genius fraudster was taken in the spring of 2009. He admitted that he had been involved in money laundering for many years. After 3 months, a trial was held, and the former businessman was sentenced to imprisonment for a term of 150 years. A year later, his son was found hanged in his New York home. Upon learning of this, his father fell into a severe depression. Madoff's other son, Andrew, was stronger. He continued to own his own energy company. In an interview with one of the major print media, Madoff admitted that he is most worried about the harm that he did to his family. But in prison they treat him very well, because whatever one may say, he is a thief, although not a pickpocket or a householder. And to those in prison - a respectful attitude. And Madoff admitted that he was most comforted by the fact that his investors were able to return half of their money, that is, 50 cents for one dollar. He consoled himself with the fact that, if there hadn’t been his fund, these people would have lost their money anyway, trusting other funds. Of course, for many, his confessions sounded very cynical, and no one could understand if he really repented or not. But the fact that his son could not bear the accusations and distrust on the part of society and committed suicide, of course, he very much repented.

Bernard Madoff: films about the great swindler

In the past few years, several paintings, both documentary and artistic, have come out that tell about the life and work of the largest financial fraudster in the history of mankind. So in 2006 the trailer "Maydoff" was shot. However, the viewer did not quite like him. Another film about Bernard Madoff - “Liar, great and terrible,” starring the unrivaled Robert de Niro and Michelle Pfeiffer, was more successful. Filmmakers, however, were not limited to these two. A picture was also shot of financial analyst Gary Makropoulos. It was called “Chasing Madoff” and was based on real events, and in her presentation there is such a line: “Unfortunately, the film was created on the basis of real events”. Opinions about this film were ambiguous, someone liked it, and left someone indifferent. There are several more documentaries about the great scammer. One of them is called the "Swindler of the Century." By the way, after the Christmas holidays, in January 2017, all newspapers again remembered the name of the super-proffer. And immediately everyone found out where Bernard Madoff was sitting, in which prison. After all, he, as already mentioned above, decided to show his entrepreneurial talent and, having bought the entire batch of cocoa powder, began to resell it to prisoners with a profit for himself. That is his essence. In a word, only the grave will correct the hunchback ...