In recent years, starting in 2010, rates on state duties on the import of cars from Japan have become very high. And it does not matter who you are: an individual or a legal entity. For this reason, many Russians simply cannot go through this procedure. It is worth noting that in many ways this cannot be done because people do not even try.

At the beginning of 2019, it is very difficult to transport a car from Japan to the Russian Federation, but it is profitable and profitable. All the problems lie not in the fact that there are expensive cars. And not even that this operation is prohibited. The thing is that customs clearance of a car from Japan is very expensive.

In this article we will consider the amount of state duties, and also understand how to properly go through the customs clearance procedure. After all, 90% of dealers end their activity on the fact that they do not have the opportunity to pay a tax for customs clearance of cars from Japan. And as we know, cars in this country are very good. Therefore, if you learn to import correctly and quickly, and also know the nuances and features of the procedure, you can easily earn on reselling cars.

What is the payment made of?

As you know, the process of customs clearance of cars from Japan is quite complicated. But those who are familiar with the rules and other nuances of the process can easily and simply import. The first thing to understand is what parameters are included in the cost of payment of customs duty. Here is the list:

- The cost of the car upon purchase.

- Vehicle age in calendar years.

- Technical characteristics of the vehicle (horsepower, engine displacement and its type. Example: 200 horsepower, 3.0 liter displacement, diesel engine).

It makes no difference who you are

It is worth noting that whether you are an individual or a legal entity, you will pay in any case. However, the cost of payment may vary. Usually, everything changes every calendar year.

rules

Here is the list:

- When you, as a driver, travel to another country (in this case, Japan) in order to buy a car there, you must definitely provide security for the customs. Thus, you create a guarantee for yourself. If the cost of the car is exaggerated (you do the calculation yourself), then the money that you overpaid for the car will be returned to customs. Yes, here neither you nor the seller will fall. Customs will take everything.

- When you really completely went through the process of customs clearance of a car from Japan, you will be given a certain receipt in which it will be clearly written that the registration has been completed.

- It is worth noting that, according to the rules of Japanese customs, you need to perform a customs clearance a few days before you leave the country. Otherwise, the car will remain cleared by the time you leave.

Car like luggage

It is worth emphasizing that your car will be considered as baggage that needs to be accompanied. This is the case if you do not customs cleared the car from Japan, and fill out the declaration in the form of TD-6. In this case, you may not go through this process at all, however, the machine will have a ban on registration actions.

If the car from Japan will be transported to another country in a special container in a truck or in a completely different way, then it also needs to be issued. In this case, it will be unaccompanied baggage.

Car Age Factors

It is worth understanding one thing: the year of manufacture of your car directly affects the cost of customs clearance of a car from Japan. In general, it all depends on these parameters:

- The model of your vehicle. If it was released exactly 3 or more years ago, then it will be equated with a new vehicle. If your car fits this criterion, then they start using a different technique: the price category of transport.

- If he is already more than three years old on the day of passing the car customs clearance procedure from Japan, then in this case you will be applied the method of calculating the state duty price for your engine capacity. If it is up to 1.8 liters, then the tariff for you will be exactly 3 euros. And if more than 2.3, then it is already 3.5 euros. If you own a fast car with a volume of more than three liters, the tariff will be exactly 4 euros.

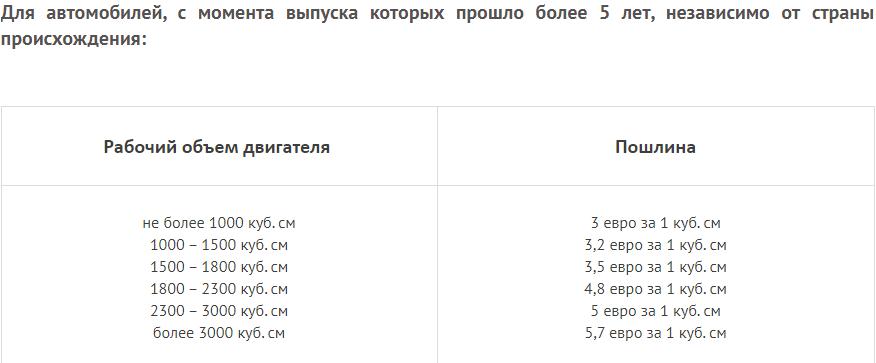

- How to calculate the customs clearance of a car from Japan, which has been in operation for more than five years? It's simple: also at a rate of 3 euros per 1 cubic meter of motor volume. However, at this rate, the rule applies to motors whose volume is exactly 1 liter. Engines with a working volume of more than a liter are equivalent to a tariff of 3.5 euros per 1 cubic meter. And if your car has a working volume of 3 or more liters, then you will have to pay 6 euros for 1 cube. In general, if we take as an example a customs clearance of a car with 3 liters of working volume, then the cost will be exactly 1 million 300 thousand Russian rubles, or 18 000 euros.

How to do it

How to perform the customs clearance procedure for a truck? Yes, everything is as simple as with a passenger vehicle. To begin with, you should follow the instructions that are written in the material and information in this article.

The algorithm is as follows:

- Registration on the selected trading floor in Japan.

- Make a deposit in the amount of the state duty payment for customs clearance of your car. This is necessary in order not to be left without money missing in case of customs clearance. If there is excess money left, then they will be returned to you at customs.

- If the driver or car owner decided to accompany his vehicle on his own, that is, to get to his homeland on his own, then you need to fill out a declaration. It will need to indicate the VIN number of the car, make and model. Thus, you can easily be let go with a cleared car.

- If escort occurs by sea transport, then in the absence of the driver at the place of unloading, the container with the machine, as well as the name of the vessel, should also be indicated on the delivery note. In this case, you will not lose your car.

- Your vehicle customs clearance documents must be sent to the customs department, where the process of delivery and transportation of your car to the country will take place. It is worth noting that other designs are also being implemented there. In general, the owner of the car will eventually receive his documents for the car and everything will be fine.

However, when you finish the process, you will have to go to the terminal for customs clearance of the car and pay the amount of Japanese state duty.