The interest of a person in quick money without unnecessary labor has led to the popularity of casinos and sweepstakes and other gambling. In most cases, bets are made on the basis of intuition or completely by accident. However, some believe that you should not rely only on fortune, but you can calculate what bet will bring a win. For this, various mathematical formulas began to be used. One such strategy is the Kelly criterion.

About Strategy

This financial strategy was developed by John Kelly in 1956. Its essence is to determine the amount of the bet, depending on the player’s bank. Using a strategy is quite complicated. And at first, the probability of losing significantly exceeds the percentage of successful bets. In addition, it does not protect against defeat and does not guarantee that all bets calculated with its application will be winning. This applies to all other existing strategies. Throughout history, no one has managed to come up with an ideal formula that always allows you to win at a casino, exchange or sweepstakes.

The essence of the Kelly criterion is to calculate the outcome of an event based on the correct analysis of various factors and the conclusion drawn on their basis. Your own assessment of the development of events should differ from what others think, for example, a bookmaker. First you need to look for those bets that, according to the player, are overvalued by bookmakers. If, in the player’s opinion, they are incorrect, then you need to bet on them, the size of which must be calculated using the formula.

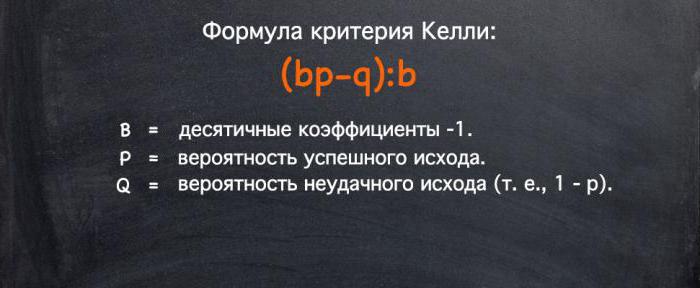

Calculation formula

Bet size = (coefficient of the bookmaker * assessment of player events - 1) / (coefficient of the bookmaker - 1)

The score for the player’s events is entered into the formula as a decimal number. That is, the probability, expressed as a percentage, must be divided by 100, and the resulting number should be entered in the formula.

How to count

One area in which the Kelly criterion is often applied is in sports betting. Technically, calculating a bet that can be placed is not difficult.

The basis is the size of the player’s cash. For example, it is equal to one thousand.

The bookmaker believes that the football club “A” will win against club “B” and the coefficient is 2.0. The player believes that the rate is too high. The reasons why his point of view is different can be very different. For example, club “A” is in better physical shape, club “B” has several injured players, which may affect teamwork. Club A usually plays well in this part of the season. As a result of the analysis, the player thinks that the probability of winning the club “A” is 58% (0.58).

The calculation will look as follows:

(2.0 * 0.58–1) / (2–1) = 0.176

To translate in monetary terms, the bet size must be multiplied by 100. As a result of calculation using the Kelly criterion, the bet will be 176.

If the outcome is unfavorable, the next rate is calculated based on the remaining funds, i.e. from 824.

Optimal calculation conditions

One of the components of success is a correct assessment of the available facts. To do this, it is recommended that it be carried out while in good physical and psychological condition. Fatigue, bad mood after losing, euphoria after winning increase the chance to make an error with the assessment of events, and the Kelly criterion will be calculated incorrectly.

The likelihood that events will develop in a certain way cannot be 100% or close to this.

Low odds should be avoided. It is advisable that they be at least 1.8. Otherwise, the gain will be negligible, and analysis needs to be spent no less than time.

Disadvantages of the strategy

Kelly's criterion is a strategy that does not allow you to get rich instantly. According to experts, the average profit at a wound rate of 5%. Its increase is possible with constant correct prediction of events, which does not always happen. To do this, you need to gain experience, so beginners are not advised to use this strategy.

To win more, you need to have a pretty good bank reserve. Experts say that it should be equal to at least 15 average player bets.

Strategy Benefits

The main advantage of the Kelly criterion is a pretty good protection against losing. If a person is mistaken and loses a bet, then this is far from all the money that he has. Moreover, as the bank decreases, the size of the subsequent rate decreases. Therefore, you can play for a long time. If defeats are replaced by wins, which happens almost always, then you can play almost endlessly.

Those who have just started using the method of Kelly’s criterion are advised not to bet based on the calculation according to the formula, it can be done a little less or even reduced by half. As you acquire the necessary knowledge in the field of estimating the odds of bookmakers and developing an effective approach to the analysis and prediction of events, the rate may be equal to the calculated one.

In addition, this strategy often makes money. With proper analysis and calculations, a stable income is guaranteed. The higher the bank, the higher the rate, which can significantly increase the winnings. But the amount of loss in the event of an error also increases.

The Kelly criterion is applied on the stock exchange, in the casino and for determining bets on the results of sports competitions. Due to the complexity of the strategy, many players prefer to use other strategies that are equally effective. In this case, the player is not required to be limited to using only one calculation method, several can be used simultaneously.